The Employee Retention Credit (ERC) is a unique tax credit made to help businesses affected by COVID-19. While ERCs generally benefit companies and employees, this article also explores can independent contractors get erc credit.

Key Takeaway

- Independent contractors are generally not eligible for the Employee Retention Credit (ERC). It is intended for businesses that have employees, not independent contractors.

- ERC is designed to financially support businesses with significantly reduced workforces due to COVID-19.

- 1099 employees, who are independent contractors or self-employed individuals, are not eligible for ERC.

- Sole proprietors may be eligible for ERC if they meet certain requirements, such as experiencing a significant decline in gross income or a partial or total halt of business operations.

- To claim ERC as a self-employed individual, you must calculate the credit for sick, and family leave based on your daily rate. You must determine the number of eligible days, subtract any already claimed days, and file IRS Form 7202.

Can Independent Contractors Get ERC Credit

Employee retention credits (ERCs) are often ineligible for independent contractors. ERC wants to provide firms that have paid employees financial support. By definition, Independent Contractors are considered self-employed, not employees. As a result, the ERC requirements still need to be met.

These loans are primarily intended for businesses that have significantly reduced their workforces. This happened as a result of the epidemic while still keeping employees despite difficulties. The particular credit is not available to independent contractors who operate their independent firms.

For the best advice, hiring professionals for this job is recommended. R&R Agency is an expert on these matters, and they will provide you with personalized assistance!

Can You Get ERC With 1099 Employees?

You are not eligible for erc for 1099 employees. Here is a brief explanation:

What is ERC For 1099 Employees

- 1099 employees are independent contractors or self-employed individuals.

- They are independent contractors rather than conventional workers.

Eligibility of ERC

- The ERC was created to assist employers who hire workers instead of independent contractors.

- You must be an employee who satisfies specific requirements to be eligible for ERC, such as paying earnings subject to tax withholding.

Applicability of ERC

- Employers that have been severely impacted by the COVID-19 outbreak yet have kept their staff members are the focus of the ERC.

- The ERC offers financial support to qualified workers. But, it does not cover independent contractors.

Difference between Employees and Independent Contractors

- An employer oversees workers and determines their working hours. They provide the necessary tools and training and handle payroll taxes on their behalf.

- On the other hand, independent contractors have greater control over their job. They are in charge of their taxes.

Can A Sole Proprietor Get ERC Credit?

Under certain conditions, ERC for a sole proprietorship can be eligible. Here is a brief description:

Sole Proprietorship

- A company structure known as a sole proprietorship is one in which a single individual is the owner and operator.

- The business and the owner are classified as entities for taxation purposes.

Eligibility For ERC

- You must fulfill various requirements to qualify for the ERC for self-employed.

A: Experiencing a significant decline in gross income or a partial or total halt of your business operations due to government contracts.

B: You could have workers or be subject to payroll tax or withholding tax obligations.

Qualifying For ERC

- You are regarded as an employer and an employee as the sole proprietor.

- You can be eligible for erc for self-employed based on your pay.

- The wages must be eligible, which includes achieving specified salary requirements. Also, being paid during the qualifying period is important.

Claiming The ERC

- You must fulfill IRS standards to file for an ERC as a sole owner.

- This entails figuring the credit’s dollar amount based on the eligible income. Also, disclosing it on the appropriate tax form, such as Form 941 or Form 944.

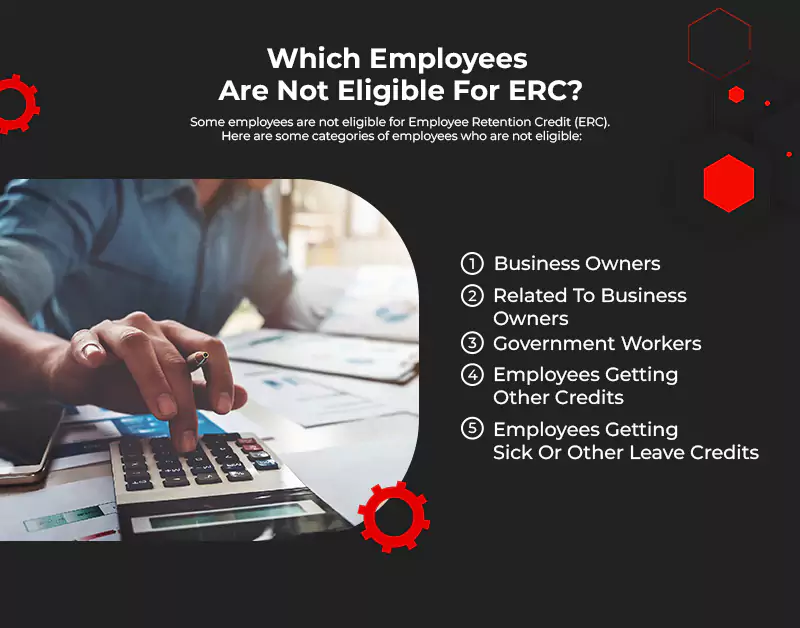

Which Employees Are Not Eligible For ERC?

Some employees are not eligible for Employee Retention Credit (ERC). Here are some categories of employees who are not eligible:

-

Business Owners

According to their income, business owners—including single proprietors, partners in companies, and shareholders of companies are not eligible for the ERC. This also includes individuals owning more than 2% of the business.

-

Related To Business Owners

Family members of business owners are often ineligible for ERC. Such as children, parents, or siblings are often ineligible for ERC if they work for the business.

-

Government Workers

ERC is often unavailable to federal, state, or local government employees. This also includes elected politicians. Verifying with the IRS for detailed instructions is essential because there could be exceptions.

-

Employees Getting Other Credits

These advantages must be unique to employees who already got them via other tax credits. Such as the Work Opportunity Tax Credit (VOTC) for the same wage.

-

Employees Getting Sick Or Other Leave Credits

Employees are often not qualified for the ERC during the same period if they also earn sick or family leave credits. They are mostly given under the Families First Coronavirus Response Act (FFCRA).

Who Is Eligible For ERC Tax Credit?

Several businesses are eligible for the Employee Retention Credit (ERC). The following are some essential qualifications:

Business Activities

- Due to COVID-19-related government laws, employers must have experienced the termination of some or all employees.

- The employer’s gross revenue has decreased significantly, and this decrease is subject to specific IRS regulations.

Time Frame Of Eligibility

- The ERC is accessible for qualified earnings earned after March 12, 2020, and before January 1, 2023.

Company Size

- Qualified employers can generally hire up to 100 full-time staff members in tax year 2020.

- Qualified employers can employ up to 500 full-time workers in the prior quarter beginning with the tax year 2021.

Employee Retention

- Employers must demonstrate that they kept their workers throughout the waiting time.

- All salaries provided to employees during the waiting period are eligible for credit for small firms, regardless of whether they performed.

- Only wages given to workers who cannot execute their duties because of a whole or partial suspension of employment are considered for big businesses. It is also considered for big companies if there is a considerable decrease in gross income.

How to Claim Self-Employed ERC Credits

You must claim the ERC self-employment credit on your 2020 or 2021 tax return. You can claim sick leave or family leave credit. This can be for whenever you cannot work in 2020 or the first nine months of 2021 due to a COVID-related reason.

You can also apply for this loan if you need the money for a COVID-19-related purpose between April 1, 2020, and September 30, 2021.

Here is a summary of the process for requesting these credits.

-

Calculate ERC For Sick Leave

The loan’s cost is based on your salary as an employee. For the days you cannot work due to illness or quarantine, you can be eligible to receive 100% of your regular daily income. It can be up to $511.

The IRS advises people to divide their yearly income by 260 to determine their daily income. It will demonstrate how much money you can earn daily if you work five days a week with no offs.

-

Determine ERC For Family Leave

Self-employed workers can receive 67% of their daily rate back if they are off work. The reason can be caring for someone with the virus or if their school is closed due to the illness.

To determine your daily rate, multiply the result by 67 using the arithmetic above.

-

Figure Out Days For ERC Credit

To assist with your COVID-related issues or those of someone other than your child, you can apply for up to 10 days of credit. Even if you cannot work for more than ten days, you can only claim 10 days of glory.

This self-employment COVID tax credit is 67% of your average daily rate or up to $200 daily. It is valid for up to 50 days. If you miss ten weeks of work, the credit is up to $10,000.

-

Minus Days Already Claimed

The IRS has regulations to stop people from claiming these credits again. Any COVID sick leave or family leave you have previously received from an employer must be subtracted from the number of days you are still eligible for.

Additionally, you can only claim the maximum number of days once. For instance, if you claimed three days on your 2020 tax return, you would only have seven more days to claim on your 2021 tax return.

-

File The Form

These significant COVID credits can be claimed by self-employed people using IRS Form 7202. It is called “Sick and Family Leave Credits for Certain Self-Employed Persons.” This one-page form will guide you through multiple calculations to determine your COVID self-employment tax.

-

Enjoy Your ERC Credits

Self-employed Tax credits for Covid are entirely reimbursed. This implies that you can use your tax credit to cover your annual taxes, but any extra money will be returned to you.

Even though most individuals have already submitted their tax returns for 2020 and 2021, it is still possible to apply for the benefits. In 2022–2023, you can still use COVID credits.

You can modify tax returns and request refunds when you discover new information about your tax position. But you must do so within three years of the return’s due date.

After filing, wait patiently for it. Many factors can affect the processing time for the ERC Credit.

Mistakes To Avoid

For self-employed people who cannot work owing to Covid-related issues, the ERC Credit can be quite beneficial. Make sure your credit application is completed accurately. To steer clear of typical errors, remember these tips:

- Use the correct year’s IRS Form 7202.

- Please read the instructions carefully to guarantee that you correctly complete the form.

- Remember that you can use your current income from the previous year. This is to determine your average daily rate.

- If you need to change a tax return that has already been filed, be sure you make it to the deadline.

- Have proof of your rights in case the IRS examines your tax return.

Conclusion

ERC is accessible to qualified employers, including independent contractors. It is for the ones who have seen a substantial decline in sales or an interruption in operations due to COVID-19. It can be entirely or in part.

We understand that filing for ERC credits can be complicated. So, it’s best to let R&R Agency do the work for you!