Suppose you’re waiting for a refund through the Employee Retention Credit (ERC) and finding it challenging to navigate the application procedure.

In that case, how long does the ERC credit take? Let’s explore the steps involved in applying for the ERC and identify factors that can speed up the processing time.

Key Takeaway

- The processing time for the Employee Retention Credit (ERC) can vary depending on several factors. These factors include the accuracy and completeness of your application, the timeliness of filing, the required documentation, the method of filing, the IRS review and approval process, and any follow-up communication that may be necessary.

- There is no exact timeline; it is essential to ensure that your application is accurate and complete, file it as soon as possible, provide all necessary documentation, consider filing online, be patient during the review process, and follow up with the IRS if needed.

- When checking the status of your ERC refund or your 941-X refund, you can use the “Where’s My Refund?” tool on the IRS website. This tool requires you to provide specific information such as your Social Security Number (SSN) or Employer Identification Number (EIN), the filing period, and the expected refund amount.

- Getting help with your ERC refund can offer several benefits, including access to expertise and knowledge, an increased chance of approval, saves time and effort, maximizes refund amount, audit support and compliance, and peace of mind.

How Long Does The ERC Credit Take

Applying for the Employee Retention Credit (ERC) can be complex.

You must be eager to know how long it takes to receive the credit. While the exact processing time can vary, several factors must be considered.

Let’s break it down for you and explore the timeline for your ERC credit.

Before that, let’s discuss Employee Retention Credit (ERC).

Understanding the Employee Retention Credit

The Employee Retention Credit is a tax incentive designed to help businesses retain employees during challenging times, such as the COVID-19 pandemic.

It provides a refundable tax credit for qualified wages paid to eligible employees. If you meet the eligibility criteria, you can claim this credit to offset your payroll taxes or receive a refund.

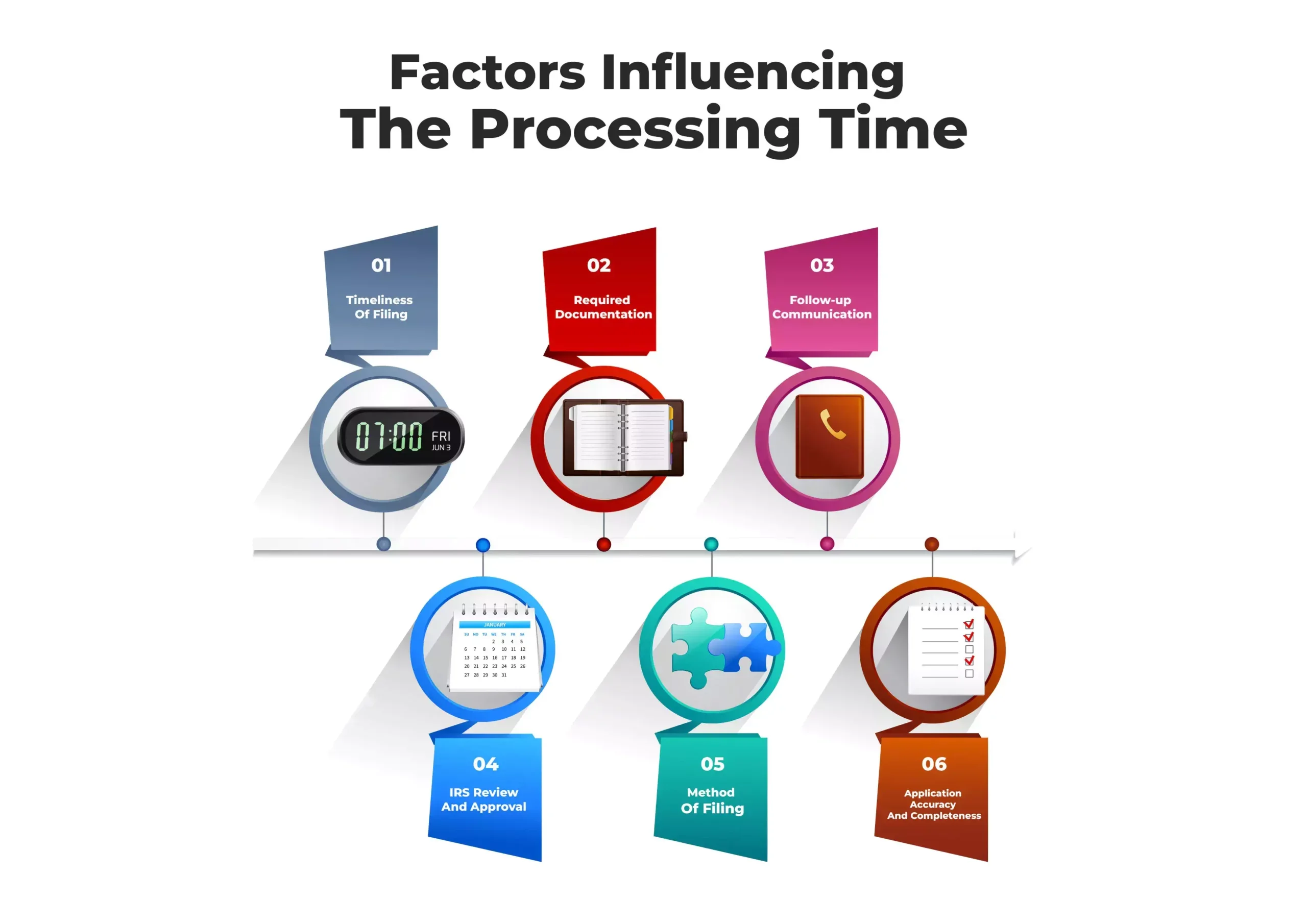

Factors Influencing the Processing Time

Many factors can affect the processing time for the ERC Credit. Let’s look at them and understand how they can impact your timeline.

1. Application accuracy and completeness:

When applying for the ERC credit, you have to make sure to provide accurate and complete information. Any errors or missing details can cause delays in processing.

Take the time to review your application and ensure all the required data is provided.

2. Timeliness of filing:

Submitting your claim as soon as possible is essential to avoid unnecessary delays.

The sooner you file your application, the sooner it will be processed. Remember that the IRS processes applications on a first-come, first-served basis, so early filing is beneficial.

3. Required documentation:

To support your ERC claim, you must include relevant documentation, such as payroll records, financial statements, and evidence of business closures or reduced operations. Providing the necessary documents and your application helps the IRS assess your eligibility and speed up the review process.

4. Method of filing:

Please consider filing your ERC online application. Digital applications are processed faster than paper submissions. The IRS has digital systems that can expedite the review and approval process.

5. IRS review and approval:

Once you submit your application, it undergoes a review process by the IRS.

The length of this review period can vary depending on various factors, including the volume of applications received and the complexity of your claim. Generally, the IRS can take several weeks to months to complete its review and approve the application.

6. Follow-up communication:

If you have yet to receive your ERC credit within a reasonable timeframe, you can contact the IRS for an update on the status of your application.

Be prepared to provide any additional information they may need. Following up can ensure your claim is processed and promptly address potential issues.

The processing time for the Employee Retention Credit can vary. While there is no exact timeline, the above factors can affect the processing speed. It’s essential to be patient, stay informed during this process, and seek guidance from the R&R Agency.

We are an expert agency that assists business owners in claiming their Employee Retention Tax Credit with the IRS.

How To Check ERC Refund Status Online

After applying for the Employee Retention Credit (ERC) and eagerly awaiting your refund, you may wonder how to check the status of your ERC refund online.

Fortunately, there are convenient ways to track the progress of your refund online. Let’s explore the steps in checking your ERC refund status online in easy-to-understand terms.

1. Gather necessary information:

Before checking your ERC refund status online, make sure you have the following information readily available:

- Social Security Number (SSN) or Employer Identification Number (EIN) associated with the ERC claim.

- The filing period for which you applied for the ERC refund.

- The amount of the refund you are expecting.

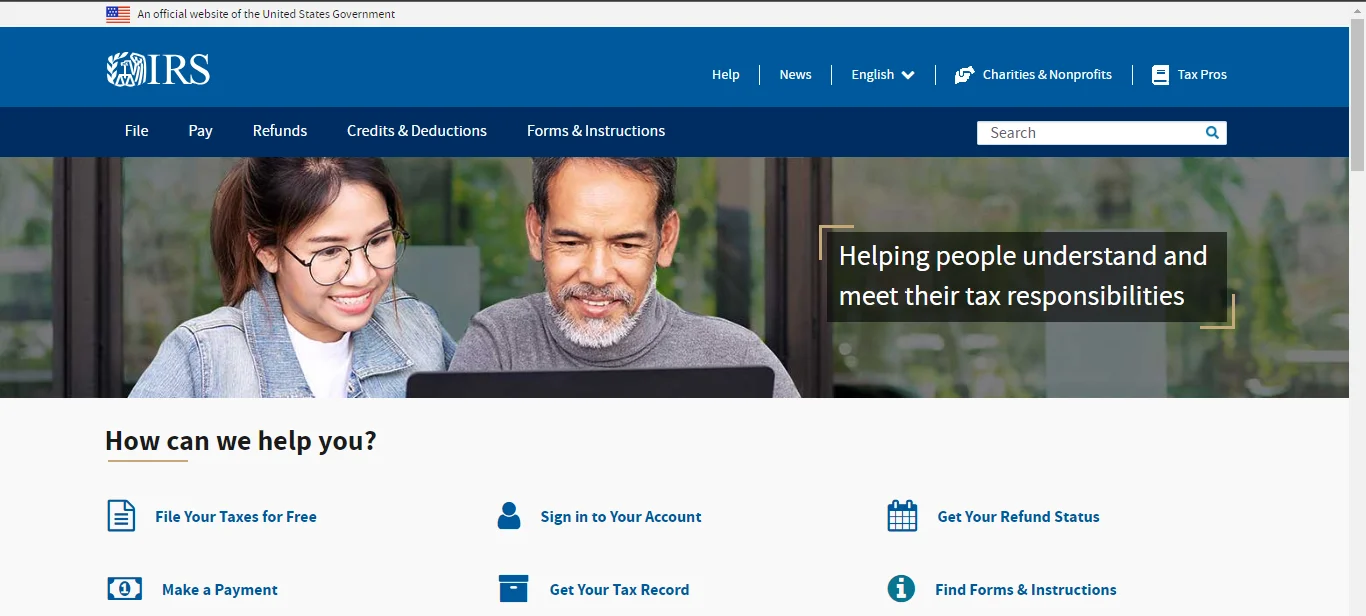

2. Visit the official IRS website:

Access the Internal Revenue Service (IRS) official website. This is the authoritative source for tax-related information and services.

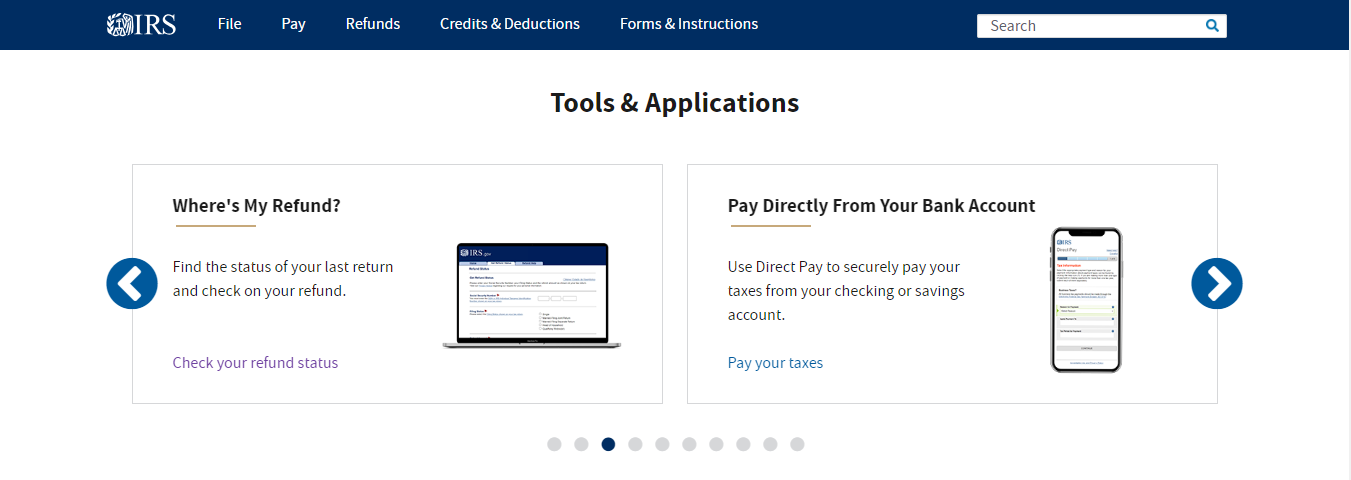

3. Navigate to the “Where’s My Refund?” tool:

The “Where’s My Refund?” The tool is on the IRS website. You can usually find it on the homepage or under the “Tools” section. Click on the link to proceed.

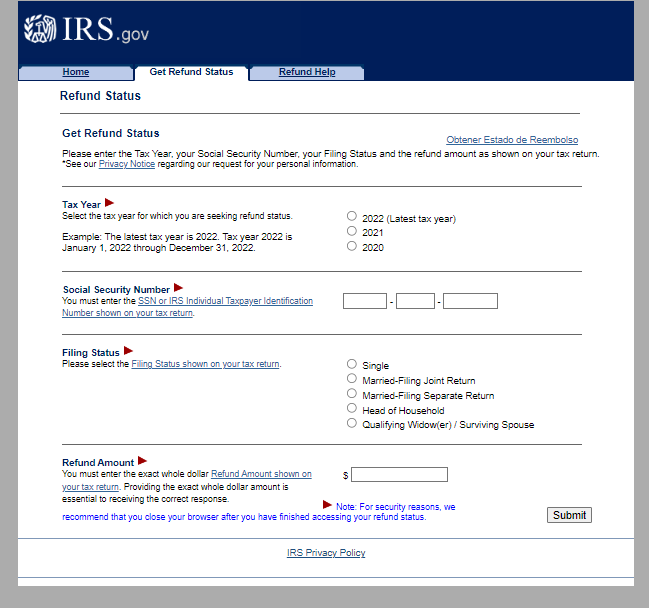

4. Enter the required information:

The “Where’s My Refund?” tool will prompt you to enter specific information to retrieve your ERC refund status.

Provide the requested details, including your SSN or EIN, the filing period, and the expected refund amount. Double-check the accuracy of the entered information before submitting.

5. Submit your information:

After entering the required information, click the “Submit” or “Check Status” button. Based on the provided details, this will initiate the search for your ERC refund status.

6. View your refund status:

Once you submit your information, the “Where’s My Refund?” tool will display your ERC refund status. The status may fall into one of the following categories:

- Received: The IRS has successfully received your ERC refund application.

- Approved: Your ERC refund has been reviewed and approved by the IRS.

- Sent: The refund has been sent to your designated payment method, such as direct deposit or by mail. You may also see the expected date of receipt.

- Under Review: The IRS is currently reviewing your ERC refund application. This status may indicate that additional information is required, and you may need to provide further documentation or clarification.

- Rejected: Your ERC refund application has been denied, and you will receive an explanation. In this case, you may need to take corrective action or file an amended application.

7. Check regularly and follow up if needed:

Remember that the ERC refund status may be updated after some time. Regularly checking the level to stay informed about any changes is advisable.

You can call (833-553-9895) or contact the IRS for further assistance if there are significant delays or concerns about your ERC refund. The IRS provides contact information on its website for inquiries related to refund status.

Checking the status of your ERC refund online is a convenient way to track the progress of your application. By visiting the official IRS website and utilizing the “Where’s My Refund?” tool, you can easily access your refund status by entering the required information.

On the other hand, a more straightforward approach would be to hire the R&R Agency to handle the matters expertly for you!

How To Check The Status Of the 941x Refund

If you have filed Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, and are waiting for a refund, you may be wondering how to check the status of your 941-X refund.

The Internal Revenue Service (IRS) provides convenient options to track the progress of your refund. Let’s break down the steps involved in checking the status of your 941-X refund.

1. Gather the necessary information:

Before you begin checking the status of your 941-X refund, ensure you have the following information ready:

- The tax period for which you filed the amended return (Form 941-X).

- The amount of the refund you are expecting.

- Your Employer Identification Number (EIN) and other relevant identification details.

2. Access the IRS website:

Visit the official website of the IRS. This is the authoritative source for tax-related information and services.

3. Navigate to the “Where’s My Amended Return?” tool:

The “Where’s My Amended Return?” The tool is on the IRS website. You can usually find it on the homepage or under the “Tools” section. Click on the link to proceed.

4. Provide the required information:

The “Where’s My Amended Return?” tool will prompt you to enter specific details to retrieve the status of your 941-X refund.

Enter the requested information accurately, including your EIN, the tax period, and the expected refund amount. Double-check the accuracy of the entered information before submitting.

5. Submit your information:

After entering all the required information, click the “Submit” or “Check Status” button. Based on the provided details, this will initiate the search for your 941-X refund status.

6. View your refund status:

Once you submit your information, the “Where’s My Amended Return?” tool will display the status of your 941-X refund. The group can fall into the following categories:

- Received: The IRS has successfully received your 941-X refund application.

- Adjusted: Your 941-X refund has been reviewed, and adjustments have been made to your tax account.

- Completed: The refund has been processed and issued to you. The tool may provide an expected date of receipt or indicate that the refund has already been sent.

- Rejected: Your 941-X refund application has been denied, and you will receive an explanation for the rejection. In this case, you may need to take corrective action or file a corrected 941-X return.

7. Regularly check and follow up if necessary

It’s important to note that the status of your 941-X refund may not be updated immediately.

Check the status regularly to stay informed about any changes. You can contact the IRS for further assistance if there are significant delays or concerns about your 941-X refund. The IRS provides contact information on its website for inquiries related to refund applications.

Checking the status of your 941-X refund is a straightforward process using the “Where’s My Amended Return?” tool on the IRS website. By providing the necessary information, you can easily track the progress of your refund application and stay informed about any updates or changes.

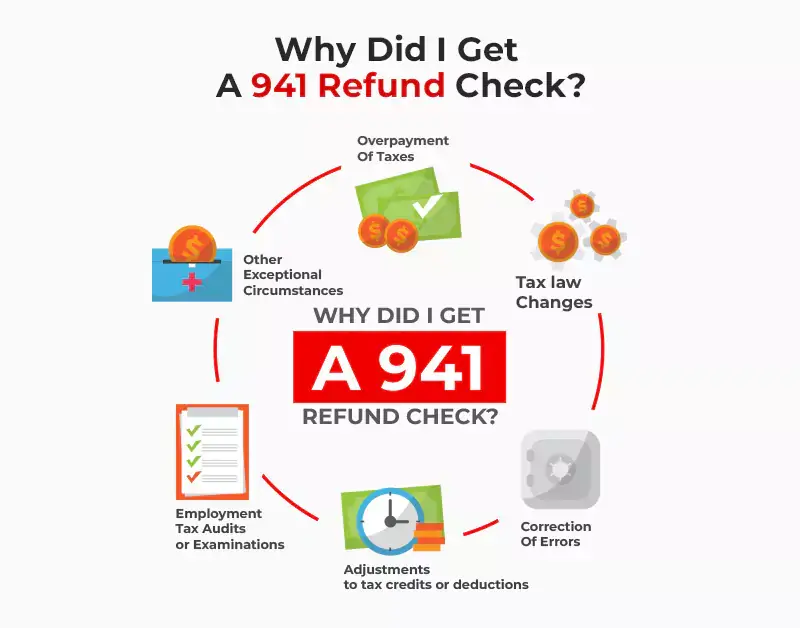

Why Did I Get A 941 Refund Check?

If you received a refund check related to Form 941, the Employer’s Quarterly Federal Tax Return, you might be wondering why you received it.

There are several possible reasons for obtaining a refund check related to Form 941. Let’s explore some common scenarios.

1. Overpayment of taxes:

The most common reason for receiving a refund check related to Form 941 is an overpayment of taxes. This can occur if you overestimate your tax liability or make excess quarterly payments.

When you file Form 941, the IRS calculates your actual tax liability based on the wages you paid to your employees. If your primary tax liability is lower than the amount you previously paid, you will receive a refund for the excess amount.

2. Adjustments to tax credits or deductions:

Another reason for receiving a refund related to Form 941 is adjustments made to tax credits or deductions. Form 941 allows employers to claim various tax credits and assumptions, such as the Employee Retention Credit (ERC) or the Qualified Small Business Payroll Tax Credit for Increasing Research Activities.

Suppose you initially claimed a lower amount for these credits or deductions and later realized you were eligible for a higher amount. In that case, the IRS may adjust your tax liability accordingly and issue a refund check for the difference.

3. Tax law changes:

When new tax legislation is enacted, it may introduce retroactive changes or modifications that impact the calculation of employment taxes.

If these changes result in a lower tax liability for employers, a refund check may be issued to reflect the updated tax obligations. Changes in tax laws or regulations can also result in a refund check related to Form 941.

4. Correction of errors:

Sometimes, employers need to correct their previously filed Form 941 returns. These errors could be related to miscalculations, incorrect reporting of wages, or other inaccuracies. If you or the IRS identify such mistakes and they result in an overpayment of taxes, a refund check will be issued to correct the discrepancy.

5. Employment tax audits or examinations:

Sometimes, employers may receive a refund related to Form 941 due to an employment tax audit or examination.

During these audits, the IRS reviews an employer’s tax records, wage payments, and other relevant documentation to ensure compliance with tax laws. If the audit reveals an overpayment of taxes or errors in previous filings, a refund check may be issued to rectify the situation.

6. Other exceptional circumstances:

There may be other exceptional circumstances that can lead to issuing a refund check related to Form 941.

These can include processing errors the IRS makes, administrative adjustments by the agency, or specific situations unique to your business or industry. Consulting with a tax professional or contacting the IRS directly for further clarification is advisable in such cases.

Receiving a refund check related to Form 941 can be attributed to various reasons, as mentioned above. Suppose you need clarification about the specific reason for receiving a refund check.

In that case, consulting a tax expert agency like R & R Tax Agency is recommended. We have all kinds of information, like the IRS ERC refund status phone number. And we are professionals in this area and can provide you with all types of guidance and clarification.

What Are The Benefits Of Getting Help With My ERC Refund?

Applying for and navigating the Employee Retention Credit (ERC) process can be complex and time-consuming.

If you are eligible for an ERC refund, seeking professional assistance or getting help can offer several benefits. Let’s explore some advantages of getting help with your ERC refund.

1. Expertise and Knowledge:

One of the primary benefits of getting help with your ERC refund is access to expertise and knowledge.

Professionals specializing in tax matters, such as accountants or tax advisors, have in-depth knowledge of the ERC provisions, eligibility criteria, and application process.

They stay updated with the latest regulations and guidelines, ensuring that your ERC refund application is accurate and compliant with the requirements. Their expertise can help you maximize your refund amount and minimize the risk of errors or rejections.

2. Increased Chance of Approval:

The ERC refund application process involves careful documentation, thorough calculations, and adherence to specific guidelines. Getting help from professionals well-versed in ERC regulations can increase your chances of approval.

They can review your financial records, identify all eligible wages and qualifying criteria, and ensure that your application meets the requirements. Their expertise can minimize the risk of errors or omissions, reducing the likelihood of your application being rejected or delayed.

3. Time and Effort Savings:

Applying for an ERC refund involves gathering and organizing various documents, calculating eligible wages, and completing complex forms.

Professionals experienced in handling ERC refunds can efficiently navigate the process, ensuring that all necessary information is gathered and accurately reported.

They can take the paperwork, calculations, and documentation on your behalf, freeing up your time to focus on other critical aspects of your business. By getting help, you can save significant time and effort.

4. Maximizing Refund Amount:

Professionals experienced in ERC refunds can help you identify and maximize the refund amount you are eligible for.

They deeply understand the intricate details of the ERC provisions, including factors such as qualified wages, qualified health plan expenses, and applicable credit rates. By leveraging their knowledge, they can identify all eligible components and optimize your refund amount, ultimately helping you receive the maximum benefit available under the ERC.

5. Audit Support and Compliance:

In the event of an IRS audit or examination related to your ERC refund, having professional help can provide valuable support.

They can guide you through the audit process, help you gather the necessary documentation, and navigate the complexities of the audit proceedings. Additionally, professionals can assist in ensuring ongoing compliance with ERC requirements, helping you maintain accurate records and stay updated with any regulation changes.

6. Peace of Mind:

By getting help with your ERC refund, you can experience peace of mind knowing that your application is in capable hands.

Professionals can provide reassurance, handle complex tax matters on your behalf, and offer guidance throughout the process. This can alleviate the stress and anxiety associated with the ERC refund application, allowing you to focus on your core business operations.

Getting help with your ERC refund can bring numerous benefits. Consider consulting our professional R&R Agency to leverage our experience and ensure a smooth and successful application process.

Our assistance can help you navigate the complexities of the ERC and optimize your refund while complying with all relevant regulations.

Conclusion

In conclusion to the question of how long the ERC credit take, the processing time for the Employee Retention Credit (ERC) can vary depending on various factors.

While the IRS aims to process refunds promptly, the exact timeline can be influenced by the volume of applications, the complexity of the claims, and any additional reviews or audits required.

Patience and regular follow-up can help track your ERC credit’s progress. Generally, it can take several weeks to several months to receive the ERC credit.

To expedite the process, it is essential to ensure accurate and complete documentation, submit the application promptly, and respond to any inquiries or requests from the IRS.