It can be overwhelming to navigate the complexities of tax incentives, particularly for businesses that employ independent contractors (1,099 employees). During difficult economic times, many companies have been saved by the Employee Retention Credit (ERC). But, the questions persist regarding its applicability to non-traditional employees.

This blog will discuss ERC authorization’s complexities for 1099 employees. By delving deeper into the criteria, nuances, and potential benefits, we intend to equip organizations with the knowledge necessary to make informed decisions.

Let’s talk about Can You Get ERC For 1099 Employees and how to maximize the ERC program’s benefits.

Key Takeaway

- The Employee Retention Credit (ERC) is a tax credit that encourages firms to keep employees in difficult economic times.

- Under certain conditions, such as trade or business suspension and correct designation as qualified service providers, the ERC is now applicable to certain 1099 employees (independent contractors).

- For organizations that rely significantly on independent contractors, ERC for 1099 employees delivers financial relief, increased cash flow, and the retention of valued personnel.

- The limitations of ERC for 1099 employees include complex eligibility criteria, interplay with other incentives like PPP, and the fact that it is not reversible.

- Certain categories, such as government personnel, tax-exempt organizations, and major enterprises with more than 500 full-time employees, are excluded from the ERC.

- Determining eligibility, identifying relevant periods, analyzing firm size, determining qualifying pay, and calculating the credit are all steps in calculating the ERC for 1099 employees.

- To ensure accurate computations and compliance with IRS requirements, claiming the ERC for 1099 employees necessitates comprehensive documentation and consultation with a skilled tax expert.

Understanding the Employee Retention Credit (ERC)

The employee retention credit (ERC) is a tax incentive designed to encourage businesses to retain workers during difficult economic times, such as the COVID-19 pandemic or other natural emergencies.

It enables eligible businesses to claim a refundable payroll tax credit, providing much-needed financial support for salaries and employee retention expenses.

Can You Get ERC For 1099 Employees

ERC grant eligibility was historically restricted to businesses that deducted and remitted payroll taxes on their W-2 employees. Nevertheless, the Consolidated Appropriations Act of 2021 made substantial adjustments, expanding the ERC’s coverage to include certain 1099 employees.

To qualify, businesses must satisfy the following criteria:

-

Trade or Business Suspension

The company must have encountered a complete or partial cessation of operations due to government contracts or a substantial decline in gross revenues. The fall must be at least 50 percent.

This is compared to the same quarter in 2020 and at least 20 percent compared to the same quarter in 2019. This is important to claim ERC business funding.

-

Service Provider Classification

The 1099 worker must be classified as a “qualified service provider” for the company to qualify. This term generally refers to individuals who provide substantial services to a company but are not deemed employees under common law.

-

Documentation and Substantiation

Businesses are required to keep comprehensive records and documentation to demonstrate their ERC eligibility. This includes contracts with 1099 employees, invoices, and other pertinent documentation showing the employee’s status as a qualified service provider.

Benefits of ERC for 1099 Employees

Eligible businesses can realize significant financial benefits by claiming the ERC for 1099 employees. They are:

-

Financial Relief for Businesses

The Employee Retention Credit (ERC) provides vital financial assistance to businesses that hire 1,099 employees. By applying for the loan, eligible companies can mitigate a portion of their labor taxes and reduce the burden of labor costs. It will also assist in retaining independent contractors during economic downturns or periods of reduced business activity.

-

Increased Cash Flow

The ERC offers a refundable tax credit, meaning businesses can receive a financial refund for any credit that exceeds their payroll tax. This can significantly improve cash flow and ensure a timely inflow of funds, enabling businesses to meet their financial obligations more effectively.

-

Retaining Valuable Talent

The ERC facilitates continuity for businesses that rely significantly on 1,099 employees by encouraging them to retain these skilled contractors. Loans facilitate the retention of experienced and specialized talent, enhancing workforce stability and expertise.

-

Additional Financial Flexibility

The provision of credit to 1,099 eligible employees expands the variety of financial support options available to businesses. It provides alternative financial assistance without excluding those who rely on contract staff, complementing other government assistance programs.

Limitations of ERC for 1099 Employees

It is essential to remember that the ERC imposes certain restrictions on 1099 employees. The credit cannot exceed the total qualifying wages of the company for the applicable period and cannot be combined with other tax benefits.

This can be the Paycheck Protection Program (PPP) loan exemption. Let’s discuss:

-

Complex Eligibility Criteria

Although the ERC has expanded its membership to approximately 1,099 employees, the eligibility requirements can be challenging due to their complexity. Some businesses may need help to meet specific needs. This is such as proving their classification as a qualified service provider, which could limit their ability to obtain the loan.

-

Interaction with Other Incentives

Credit redemption under the Paycheck Protection Program (PPP) cannot be used with ERC. Businesses considering multiple support options may need to carefully consider which option provides the most outstanding value and best suits their circumstances.

-

Limitations on Credit Amount

The ERC limits the amount of credit claimed per employee for 1099 workers. The inability of businesses to receive credit over the qualifying wages paid to the independent contractor during the eligibility period may limit overall benefits. This is especially for companies with reduced labor costs.

-

Non-Retroactive Nature

The ERC is not retroactive, so businesses can only claim the credit for future quarters, not for periods in the past. Although it provides financial support for the future, this restriction prevents companies from seeking relief from difficulties they confronted in the past.

Is ERC Only For W2 Employees?

In response to the COVID-19 pandemic, the ERC was initially established under the CARES Act and was primarily intended for corporations with W-2 employees.

This tax credit permitted eligible employers to claim a percentage of qualifying compensation paid to their W-2 employees. This is during specific pandemic-affected periods, providing financial assistance for workforce maintenance.

-

Expansion of ERC Eligibility

Changes in the law have expanded the eligibility requirements for the ERC to assist better companies impacted by the economic downturn. The Consolidated Appropriations Act of 2021 and the American Rescue Plan Act of 2021 substantially modified and expanded the ERC’s scope.

This was to include certain 1099 contractors as qualified service providers.

-

ERC for 1099 Contractors

Under the ERC’s expanded provisions, companies can now claim the tax credit for compensation paid to qualified 1099 contractors. To be eligible, businesses must meet specific requirements, such as a complete or partial cessation of operations or a substantial decline in gross sales.

In addition, 1099 contractors must meet the definition of a “qualified service provider” and be correctly classified as independent contractors under common law, as opposed to employees.

-

Calculating the ERC for 1099 Contractors

The ERC calculation for 1099 independent contractors is comparable to that for W-2 employees. Subject to certain restrictions, eligible businesses can claim a percentage of compensation paid to independent contractors during qualifying quarters.

Nonetheless, accurate substantiation of the claim requires meticulous determination and documentation of the allowable salary.

-

Advantages of ERC for 1099 Contractors

The expansion of the ERC to 1099 entrepreneurs provides numerous benefits to businesses. It offers financial assistance for companies that rely significantly on independent contractors and encourages employee retention during economic hardship.

By claiming the ERC for 1099 independent contractors, businesses can increase their cash flow, improve financial flexibility, and retain specialized talent.

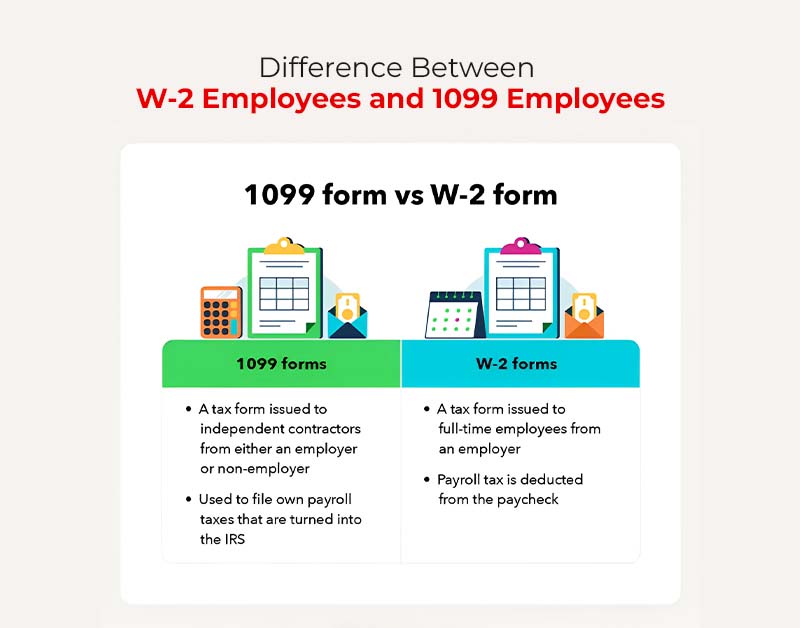

Difference Between W-2 Employees and 1099 Employees

W-2 and 1099 workers, independent contractors, differ significantly in their working arrangements, tax responsibilities, and legal protections. Here is a detailed comparison.

-

W-2 Employees

Permanent employees of a company or organization who receive a W-2 form after the tax year are W-2 employees.

Form W-2 is a federal income tax and withholding tax return filed by the employer with the employee and the Internal Revenue Service (IRS). W-2 workers are “employees” and “full-time employees.”

W-2 employees show the traditional employer-employee relationship. They are employed by the company for specific hours, typically on a fixed schedule. Also, they are generally under the control and direction of the employer.

The employer determines the work tasks, sets the working hours, and provides the necessary tools and equipment to complete the tasks. W-2 employees frequently receive employer-provided benefits such as health insurance, retirement plans, paid vacation, and other benefits.

-

1099 Employees (Independent Contractors)

1099 Employees, also known as self-employed individuals, provide services for a business or private individuals as self-employed individuals. The term “1099” is derived from the Form 1099-MISC used by the IRS to report income from independent contractors.

Unlike W-2 workers, independent contractors are not employees of the corporation they work for but operate as separate businesses.

Independent contractors have greater control over their work and are frequently hired for specific assignments or periods. They can work for multiple clients simultaneously and offer their expertise and services to various businesses.

Independent contractors are responsible for managing their own work schedule, expenses, and necessary resources. Typically, they furnish their tools and equipment.

Which Employees Do Not Qualify For ERC Credit?

Not all workers qualify for erc for self-employed. This section discusses the categories of personnel ineligible for ERC credits and the reasoning behind their exclusion.

-

Employees of Government Entities

The employees ineligible for the ERC credit category consists of federal, state, and local government employees. As the ERC is intended to offset a portion of the employer’s Social Security tax liability, these employees are ineligible for the credit. This is because they are not subject to federal employment taxes. Health insurance is also included in it.

-

Employees of Tax-Exempt Organizations

Likewise, employees of tax-exempt organizations, such as certain non-profits, are not eligible for the ERC. Tax-exempt organizations are exempt from federal employment taxes, so the credit does not apply to these workers.

-

Employees During PPP Loan-Covered Periods

Employees whose pay was used to claim an exemption under the Paycheck Protection Program (PPP) during a particular period are ineligible for Employee Retention Credit (ERC) for the same period. Companies cannot simultaneously apply for ERC and PPP loan forgiveness for the same compensation.

-

Business Owners and Family Members

Entrepreneurs, including sole proprietorships, partners, and owners of more than 50 percent of a business, are ineligible for the ERC, as are their family members. The loan should benefit the employees, not the business owners.

-

Employees of Certain Large Employers

Employers with more than 500 full-time employees are ineligible to apply for ERC. This is for workers not providing services due to government closure orders or a substantial decrease in gross income.

With this limitation, the support is intended to concentrate on small enterprises more severely impacted by economic difficulties.

-

Employee Leave Credits

Workers for whom the employer has applied for Family and Medical Leave Act (FMLA) credits and Family First Coronavirus Response Act (FFCRA) sick leave credits for the same period are not eligible for the ERC.

The ERC intends to provide additional compensation for salaries paid to eligible employees.

How to Calculate the ERC for 1099 Employees

Calculating Employee Retention Credit (ERC) for 1099 employees is more complicated than for W-2 employees because various factors must be considered. After knowing who is eligible for erc grants, let’s discuss how to calculate it:

-

Determine Eligibility

First, confirm that the 1099 independent contractors for whom you wish to claim the ERC satisfy the eligibility requirements. The admission requirements are complex and subject to change as of the September 2021 deadline.

When filling out the ERC grant application, perusing the most recent IRS instructions and consulting a tax expert for up-to-date information is essential.

-

Identify the Relevant Periods

The ERC is calculated based on specific periods during which the business confronted obstacles, such as a significant decline in gross sales or mandatory government shutdowns. Specify the calendar quarters or qualifying periods for claiming the credit.

-

Determine Qualified Wages

Qualifying wages for 1099 independent contractors include net self-employment income earned during qualifying quarters or periods. Self-employment income is subtracted from allowable business expenses to determine the contractor’s net income from self-employment.

The maximum allowable compensation is capped at a certain amount.

-

Assess Employer Size

The amount of the ERC differs based on the employer’s size. Small employers with an average of 500 or fewer full-time workers in 2019 can claim the credit for all wages.

This credit is paid to the 1,099 qualified independent contractors during the credit periods. However, large employers can only claim the credit for wages paid to employees who have yet to perform in the affected areas.

-

Calculate the Credit

The ERC is a percentage of the wages paid during eligible quarters. The ERC has been established at 50% of qualifying compensation, up to a maximum of $10,000 per employee per qualifying quarter.

However, this information may need to be updated, and the percentages and restrictions may have changed. Consult the most recent IRS guidelines for precise values.

-

Claiming the Credit

Companies must claim the ERC for 1099 independent contractors on their federal tax returns to qualify for the credit. Due to the complexity of tax laws and forms, you are strongly advised to consult a qualified tax advisor to ensure accurate calculations and reports. They will help you with everything related to the ERC funding timeline.

-

Keep Records

Maintain complete documentation of 1099 salaries, gross earnings, and other pertinent data to support the ERC claim. A well-organized record is essential, as the IRS may request credit check documents before the ERC grant deadline.

Apply for the ERC Tax Credits with the ERC Specialist

With the assistance of R&R Agency’s dedicated ERC specialists, applying for ERC tax credits has never been simpler. Our seasoned experts will guide you through the process, ensuring accurate calculations and compliance with the most recent IRS regulations.

Maximize your tax savings and maintain your profits. Contact the R&R Agency immediately to secure your financial future and claim your ERC benefits.

FAQs

-

What is the non-refundable portion of the employee retention credit (ERC)?

The amount a business cannot get as a cash refund from the IRS is the non-refundable element of the Employee Retention Credit (ERC). The excess amount is considered non-refundable if the ERC exceeds the overall tax due of the business for a given tax period.

The non-refundable amount, on the other hand, can be carried forward to offset future tax bills. It gives qualifying firms a lucrative tax credit even if they do not receive an immediate cash refund.

-

What is the 941x for employee retention credit?

Employers utilize Form 941-X to claim or modify the Employee Retention Credit (ERC) on Form 941, their quarterly payroll tax return. If an employer discovers ERC-related errors or omissions on a previously filed Form 941, they can use Form 941-X to make the necessary changes.

This form enables firms to claim the ERC and ensure compliance with IRS standards appropriately. It is critical to correctly complete Form 941-X to collect appropriate ERC credits or refunds.

-

How to calculate ERC?

Determine the qualified earnings for eligible employees before calculating the Employee Retention Credit (ERC). Eligible wages for 2020 are up to $10,000 per employee per quarter. For 2021, eligible wages are up to $10,000 per employee per quarter for Q1 and Q2 and $12,000 for Q3 and Q4.

For 2020, the credit ratio is 50%, and for 2021, it is 70%. To calculate the ERC amount, multiply the qualified salaries by the credit %. It should be noted that there are certain criteria and limitations based on the size of the firm and the time of eligibility.

Conclusion

One thousand ninety-nine employees were ineligible for Employee Retention Credit (ERC) eligibility. The ERC is intended to predominantly benefit employers with W-2 employees, encouraging them to retain their workforce during difficult economic times.

However, rules and regulations are subject to change, and the IRS routinely updates eligibility guidelines for the ERC, including the granting of credit to certain 1,099 independent contractors under certain conditions.

It is crucial to review the most recent IRS guidance to determine eligibility and current requirements for ERC claims related to 1099 employees. You can also seek tax advice from a professional like R&R Agency.